The listings featured on this site are from companies from which this site receives compensation. This influences where, how and in what order such listings appear on this site.

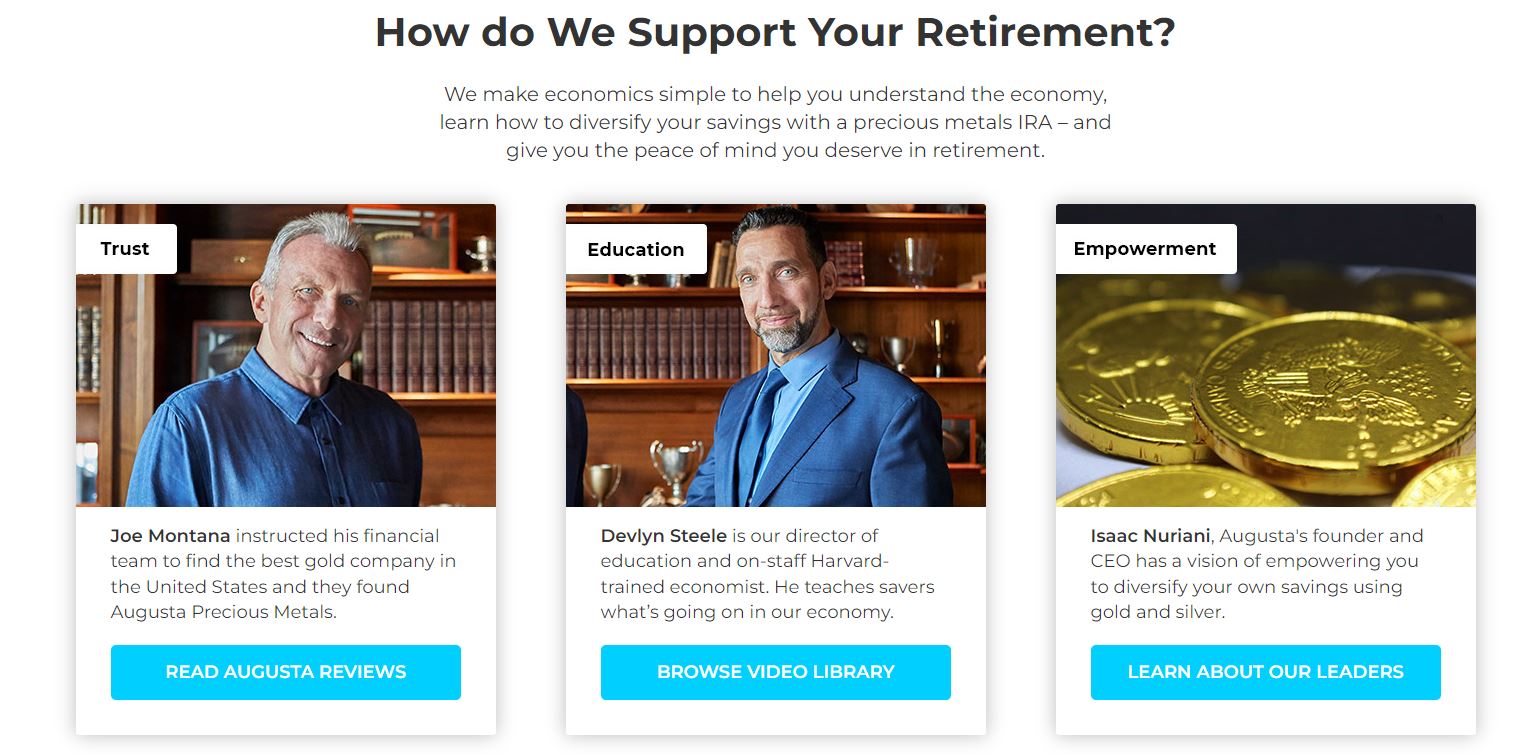

Augusta Precious Metals is dedicated to helping customers enter the precious metals investing market. Augusta offers two primary products: selling physical bullion for personal use and storing precious metals used to fund a self-directed IRA. With an endorsement by football celebrity Joe Montana, a dedicated Order Desk to field precious metals questions, and a Harvard-trained economist on staff, Augusta Precious Metals pulls ahead of the pack as a leader in the precious metals market.

There are several steps that go into creating a gold IRA: creating the account upfront, funding the account, purchasing precious metals, selecting a broker, and finding a place to store your metals. Augusta Precious Metals walks customers through two foundational IRA services: the creation of a gold IRA and the funding of an account with precious-metals purchases.

To make it easy to finalize your gold IRA, Augusta Precious Metals works with affiliate partners. For brokerage services, they partner with Equity Trust; for storage services, they work with Delaware Depository. Customers can work with these affiliate partners if they like, but they have the freedom to choose any broker or depository that they prefer.

Coins for IRAs

Augusta Precious Metals also sells gold and silver bullion that meets the IRS’ strict standards for gold IRAs. In order to be eligible to fund a precious metals IRA, bullion must meet a purity of 99.5% for gold and 99.9% for silver. There is one exception: the American Eagle gold coin, which is 91.67% pure, but IRS-approved for IRA funding.

When shopping on Augusta Precious Metals’ website, you’ll see several types of IRS-approved gold and silver coins for IRAs, including:

Augusta Precious Metals sells gold and silver bullion for direct, physical purchase. Augusta’s Order Desk works with customers in a 1-on-1 capacity throughout the metal-buying process. It’s staffed by precious metal professionals, who inform customers of spot prices, relate popular bullion choices, and review the entire catalog of precious metals in their inventory.

Below are a few examples of the gold and silver products offered by Augusta:

Augusta Precious Metals is a one-stop-shop precious metals dealer, dedicated to help every customer start their investing journey on the right foot. With help from Augusta’s Order Desk, customers can purchase authenticated gold and silver assets for IRA or personal use. Thanks to affiliate participation, IRA customers can create, fund, broker, and safely store their new gold IRA with professional guidance throughout.

Frequently Asked Questions (FAQ)